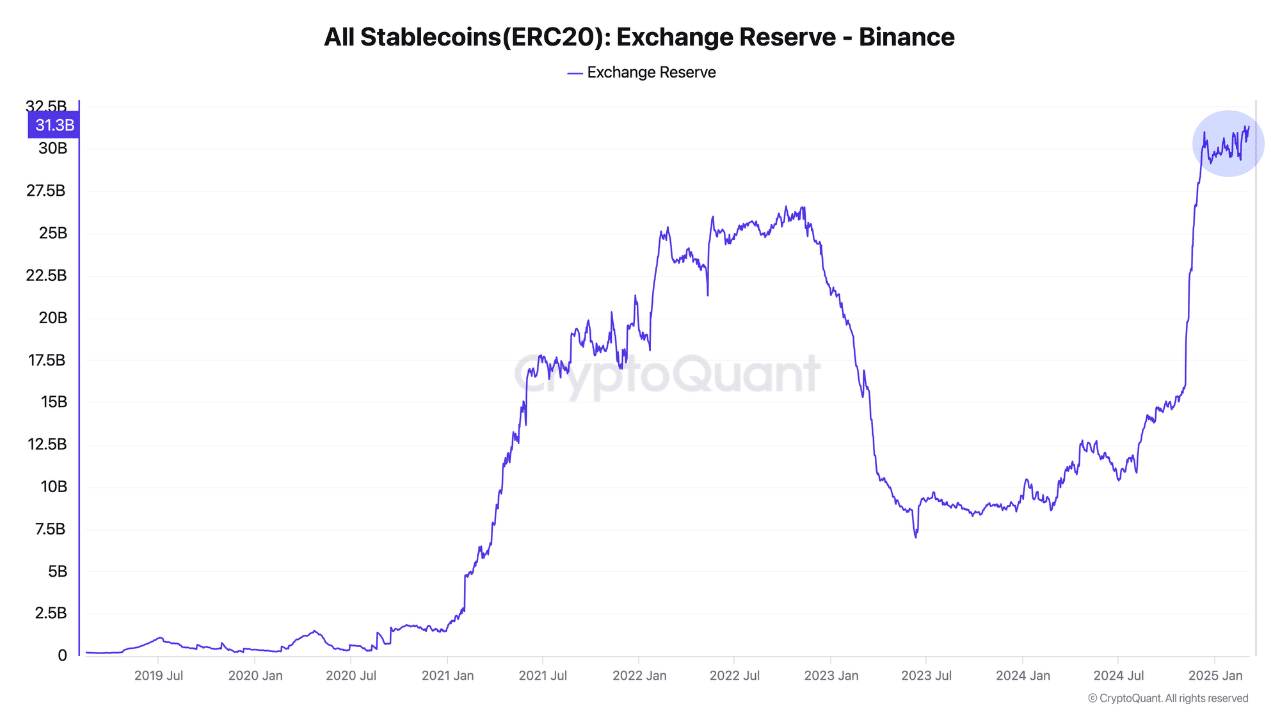

- Binance stablecoins reserve surged to record highs above $31B.

- BTC price was muted despite President Trump’s creation of a strategic BTC reserve.

Binance [BNB] stablecoins have hit a record high of $31.5B, prompting a CryptoQuant analyst to project that a Bitcoin upside could be likely. According to pseudonymous analyst Dark Fost, the stablecoin increase could be due to;

“Investors are channeling liquidity into Binance in preparation for market entry, reflecting confidence in both the market and the exchange.”

Fost added that past stablecoin spikes boosted BTC.

“Historically, periods of rising stablecoin reserves on Binance have often coincided with, or even preceded, an increase in BTC prices and a broader upswing in the crypto market.”

Liquidity conditions eased

Despite the bullish potential from the Binance stablecoins stash, the overall liquidity conditions have eased slightly.

According to CryptoQuant, stablecoins exchange inflow (which tracks on-chain liquidity) declined from $121B to $99B in early March.

Liquidity declines have limited BTC’s upward movement, while liquidity surges have triggered bounces, as observed last November and January.

In 2025, liquidity conditions have fluctuated between $60 billion and $120 billion, reflecting market volatility. Glassnode highlights that local upside momentum can only form above $92K, the average cost basis for short-term holders.

However, a sustained downside risk could force bulls to defend the $70K-$71KK as the next key support. The firm stated,

“Strong confluence between price structure and key on-chain metrics indicate that the $92k remains a critical level for Bitcoin to re-establish upwards momentum, whilst the ~$70k level appears to be a key zone for the bulls to build support if reached.”

The blockchain analysis firm reported that over $14 billion worth of BTC was purchased when prices fell below $86K, marking this as a demand zone.

This indicates that the area above $70K could act as a strong support level. From a liquidation heatmap perspective, significant liquidity was observed at $95K on the two-week chart.

Furthermore, long liquidation levels accumulated in the $75K-$77K range, reinforcing Glassnode’s analysis of potential support above $70K.

Meanwhile, the largest crypto was valued at $89K, at press time, despite President Trump’s perceived bullish creation of a strategic BTC reserve.