Goldman Sachs amplified its bet on Bitcoin ETFs by adding almost 6 million additional shares in BlackRock’s iShares Bitcoin Trust. The bank’s most recent filing with the US Securities and Exchange Commission indicates it now owns nearly 31 million shares—up from 24 million in its last report.

That holding is valued at more than $1.4 billion. It makes Goldman the largest institutional IBIT holder to date, according to MacroScope, a financial analyst.

Goldman Sachs Increases Bitcoin ETF Holdings

Goldman’s 30.8 million IBIT shares, as reported in the SEC filing, are a 28% rise from its earlier 24 million-share holding. At current market price, that portion of IBIT is worth over $1.4 billion.

MacroScope initially highlighted the shift. For comparison, competitor hedge fund Brevan Howard owns slightly more than 25 million shares—worth close to $1.4 billion on its own.

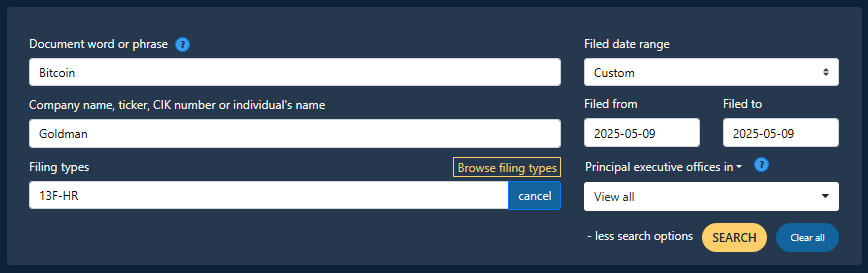

Source: SEC

Goldman Transitions To BTC

Last December, Goldman had call and put options on IBIT. At the time, it had around $157 million in calls and more than $527 million in puts. It also had $84 million in puts on Fidelity’s FBTC.

Those hedges don’t appear in the current report. Allowing them to expire indicates that Goldman might be transitioning to an easier, direct bet on Bitcoin’s price.

Image: Source: Esgnews.com

JUST IN: Goldman Sachs just disclosed owning $1.65 BILLION $BTC through Bitcoin ETFs – [@MacroScope17] pic.twitter.com/do4VBuhntN

— Bitcoin Archive (@BTC_Archive) May 9, 2025

IBIT Leads ETFs With $63 Billion

BlackRock’s iShares Bitcoin Trust has grown to almost $63 billion in assets managed, Farside Investors data indicate. The fund has amassed around $44 billion in net flows since its inception. This week alone, it received $674 million more. Friday saw IBIT shares increase by $1.04 to close at $58.66, following the top coin’s recovery above $60,000.

Wall Street Firms Follow Suit

Goldman is not the only one. Other heavy-hitters—Jane Street, D.E. Shaw and Symmetry Investments—also maintain significant IBIT positions. And Goldman itself had reported $1.2 billion in IBIT and $288 million in FBTC as of its filing in February.

The transaction indicates that large trading desks and hedge funds are seeking Bitcoin within regulated ETFs, not futures or unregulated exchanges.

Goldman Sachs’s increasing ETF stake is an indicator of increasing bank confidence in Bitcoin as a part of mainstream portfolios. With more than $60 billion stashed in IBIT alone, it’s apparent that spot Bitcoin ETFs have resonated with institutional investors.

Whether other large banks follow and how that influences Bitcoin’s price will be closely monitored in the coming months.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.