Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

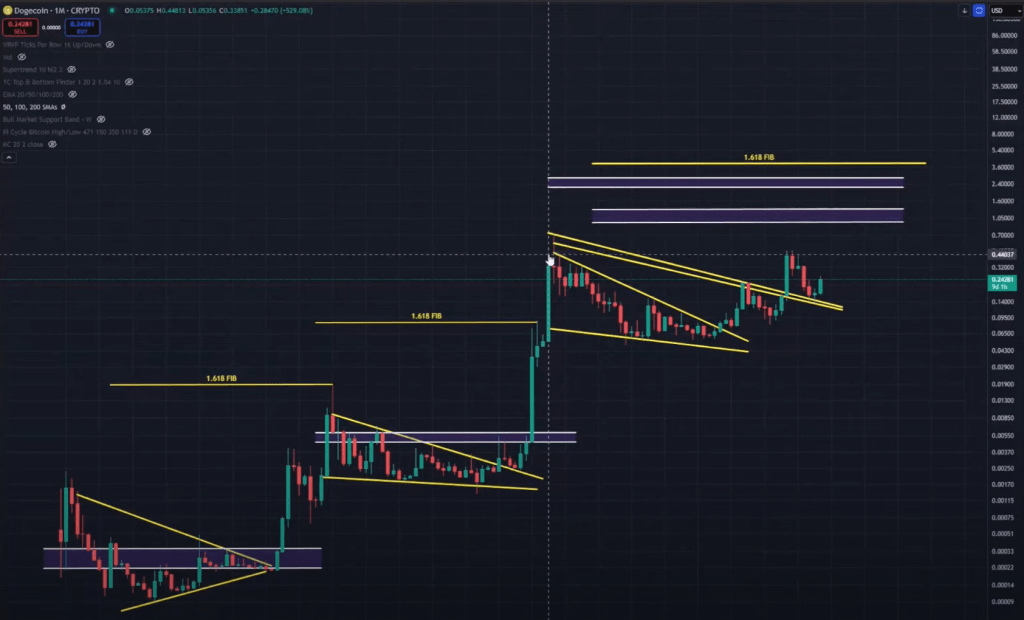

Dogecoin’s latest market structure is “significantly better than in prior bull markets,” according to Kevin, the crypto technician known on X and YouTube as @Kev_Capital_TA. In a video released Friday, the analyst mapped Dogecoin’s three historical cycles, concluding that the memecoin’s current breakout-and-retest pattern places a long-term Fibonacci extension at $3.80–$3.90 squarely “on the table”—provided one key condition holds: Bitcoin must keep grinding higher.

“Two cycles in a row, Dogecoin has tagged the 1.618 fib extension,” Kevin reminded viewers. “Here we are in the third cycle… we have evidence to suggest it has happened 100% of the time. It’s only two data points, though, so that could easily not happen this time.”

Why $3.80 Per Dogecoin Is Possible This Cycle

On a log-scale weekly chart, Kevin traced Dogecoin’s first super-cycle—consolidation, breakout, mid-cycle pullback, blow-off top—culminating at the 1.618 extension. The second cycle repeated the pattern, but “Elon Musk’s Saturday Night Live hype” punched price far beyond the fib target into euphoric territory.

Today’s third cycle, he argued, looks healthier: successive breakouts and back-tests of the bear-market range have carved a rising channel of higher highs and higher lows anchored by the 200-week EMA/SMA cluster. “This structure looks really good to me… break out, back-test the 200s, make a higher low—it’s textbook.”

On the monthly chart, the Relative Strength Index is “just strength—constant higher lows,” still far beneath the 80-to-90 zone that capped prior cycle tops. Kevin also flagged a V-shaped curl in the monthly Stoch RSI—a signal that “should provide the momentum we need to really get a durable run higher” once it crosses the 20 line.

Related Reading

The two-week Market Cipher readout shows three years of progressively stronger momentum waves and money-flow inflows. “This is big-time stuff,” he said, circling each expansion. “Momentum is compressing and building to a point where it’s like, okay, now it’s time to release it.”

A fresh two-week Stoch RSI cross historically precedes “bang, big move higher,” he added, implying that the post-halving phase could usher in Dogecoin’s next parabolic leg.

For traders fixated on nearer horizons, Kevin highlighted a macro golden pocket stretching from $0.26 to $0.285, reinforced by the daily 200-SMA at $0.27. That zone caps a developing bull-flag whose measured move targets $0.32–0.33. The pattern sprang out of an inverse head-and-shoulders accumulation at $0.15, a level he “accumulated heavily,” now up roughly 60%.

“Treat resistance as resistance until it isn’t,” he cautioned, noting that Bitcoin dominance near 64% still siphons liquidity from altcoins. Yet he sees “serious signs” that dominance has printed a local top at 65.45%, opening room for a rotation into majors like Ethereum and, by proxy, Dogecoin.

This Needs To Happen

If Bitcoin stability endures and macro conditions—softening inflation, steady labor data, potential Fed easing—remain supportive, Kevin’s next “main price target” is the 2021 all-time high just under $1.00. A decisive break there would turn eyes to the cycle’s 1.618 extension near $3.80.

Related Reading

“I’d be shocked at this point if we don’t go to that level,” he said, while stressing disciplined profit-taking: “There’s nothing worse than riding a move all the way up and not taking profits.”

Kevin rebuffed the wilder six-and-seven-dollar predictions circulating on social media but insisted that a $3-plus Dogecoin is “absolutely possible” if Bitcoin pushes toward $200,000, quantitative tightening ends, and a full-blown altcoin season erupts.

Dogecoin remains “one of the most popular cryptocurrencies on the planet,” the analyst observed. “When retail comes piling back in, they’re always piling back into Dogecoin.” That psychological feedback loop, combined with a structurally bullish chart and improving momentum gauges, underpins his conviction that the memecoin could reprise its role as the spearhead of a broader altcoin surge.

Whether the market delivers the necessary macro tailwinds is the wildcard. But Kevin’s message was unambiguous: for now, Dogecoin’s technical canvas paints a credible route to $1, and the elusive $3.80 marker “is possible—if Bitcoin holds ground and the macro stays peachy.”

At press time, DOGE traded at $0.243.

Featured image created with DALL.E, chart from TradingView.com