Imagine this: You wake up, check your phone, and see that Bitcoin has dropped 20% overnight. Panic sets in. Should you sell? Hold? Buy more? You scroll through Twitter—some people are screaming “bear market,” others say it’s just a dip. Your heart races. You wonder if you’ve made a mistake.

Welcome to the world of crypto trading. It’s fast, exciting, and sometimes terrifying. The market moves at lightning speed, and emotions can take over before you even realize it. But here’s the truth: managing risk and controlling fear are the keys to survival and success. If you can master these, you’ll stay in the game long enough to win.

So, let’s talk about how you can protect yourself and trade with confidence, no matter what the market throws at you.

Understanding Risk in Crypto Trading

Risk is part of the game. There’s no way to completely remove it, but you can manage it smartly. Let’s break it down.

1. Volatility: The Double-Edged Sword

Crypto markets are known for their wild swings. Unlike stocks, where a 5% move in a day is a big deal, crypto can move 20-30% within hours. This volatility creates opportunities but also dangers.

Example: Imagine you buy Ethereum at $2,500, thinking it will go up. Suddenly, bad news hits, and it drops to $2,000. If you’re not prepared, you might panic and sell at a loss. But if you had a plan, you would know exactly what to do.

2. Position Sizing: The Golden Rule of Survival

Never put all your money into one trade. A common rule among smart traders is the 1-2% rule—never risk more than 1-2% of your total capital on a single trade.

Example: If you have $10,000 to trade, risking 2% means you won’t lose more than $200 on any trade. This keeps you in the game even if you have multiple losing trades.

3. Stop-Loss and Take-Profit: Your Safety Nets

A stop-loss is a price level where you automatically exit a trade to prevent further losses. A take-profit is the opposite—it locks in profits at a predetermined price.

Example: You buy Bitcoin at $50,000 and set a stop-loss at $48,000. If the price drops, you exit automatically, limiting your loss. On the other hand, you set a take-profit at $55,000 to secure gains if the price goes up.

4. Diversification: Don’t Put All Your Eggs in One Basket

Putting all your money into one coin is risky. Spreading your investments across different cryptos or even other assets reduces your risk.Example: Instead of putting everything into Bitcoin, you could hold 50% in BTC, 30% in Ethereum, and 20% in other altcoins. If one drops, the others might balance it out.

Dealing with Fear in Crypto Trading

Fear is what makes traders panic-sell at the worst moments. It’s natural, but you need to control it. Here’s how:

1. Accept That Losses Are Part of the Game

No trader wins 100% of the time. Even the best traders lose money sometimes. The key is to lose small and win big.

Example: If you take 10 trades and win 6 while losing 4, you can still be profitable if your wins are bigger than your losses. It’s all about risk-to-reward ratio.

2. Stick to Your Plan (And Avoid Emotional Trading)

One of the worst mistakes is trading based on emotions rather than strategy. A trading plan helps remove emotions from decisions.

Example: You decide in advance, “I will buy at this price, set my stop-loss here, and take profit here.” Then you stick to it, no matter what.

3. Avoid Checking Prices Every Minute

Watching the charts all day can drive you crazy. Small fluctuations don’t matter in the long run, but they can make you anxious in the short term.

Solution: Set alerts at key price levels so you don’t have to constantly check.

4. Learn to Zoom Out

Crypto has had massive crashes before, but it has always bounced back over time.

Example: Bitcoin crashed from $20,000 to $3,000 in 2018. Many people panicked and sold. But those who held saw it reach $69,000 in 2021. Short-term fear leads to bad decisions; long-term thinking wins.

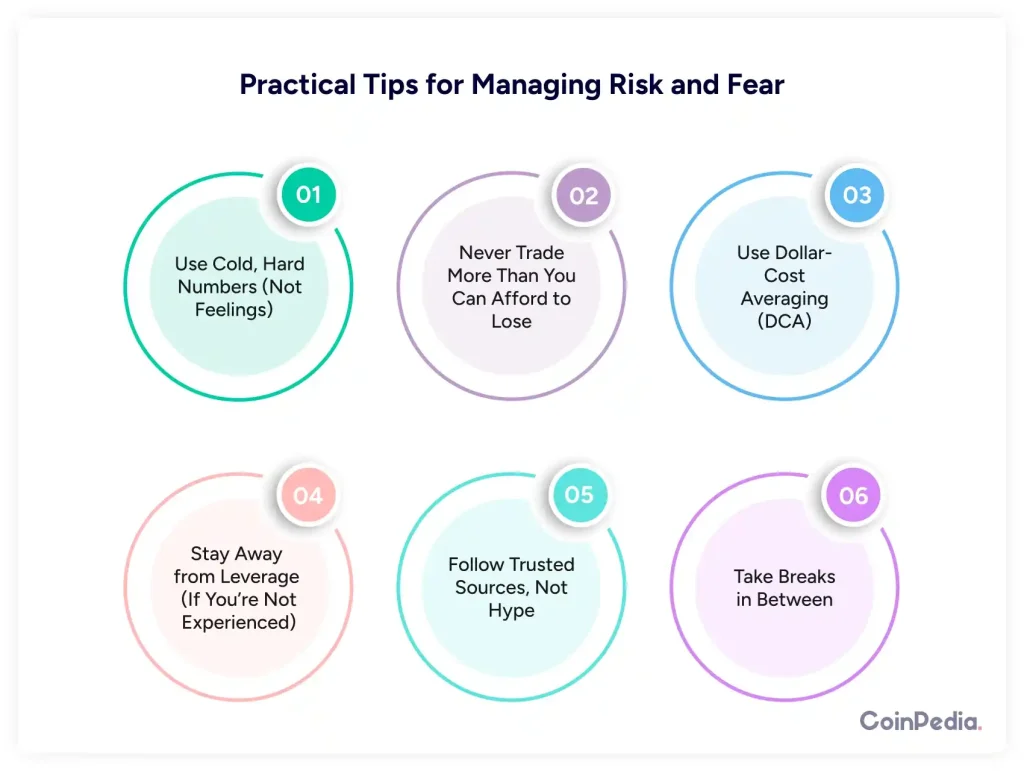

Practical Tips for Managing Risk and Fear

- Use Cold, Hard Numbers (Not Feelings): Before entering a trade, write down your entry, exit, and risk level.

- Never Trade More Than You Can Afford to Lose: If losing a trade would ruin your day, you’re risking too much.

- Use Dollar-Cost Averaging (DCA): Instead of going all in at once, buy in small amounts over time to reduce risk.

- Stay Away from Leverage (If You’re Not Experienced): Borrowing money to trade can wipe you out fast.

- Follow Trusted Sources, Not Hype: Avoid trading based on random Twitter posts or YouTube predictions.

Take Breaks: If you’re feeling overwhelmed, step away from the charts for a while.

Final Thoughts: The Secret to Long-Term Success

Trading crypto is not about making a quick buck—it’s about staying in the game long enough to make consistent profits. Managing risk and controlling fear are what separate winners from losers.

The next time the market crashes, take a deep breath. Remind yourself that this is normal. Stick to your plan. Over time, discipline and strategy will make you a successful trader.

Remember: The market rewards patience and punishes fear-driven decisions. Play the long game, and you’ll come out ahead.

FAQs

Crypto markets lack regulation, have lower liquidity, and are driven by speculation, leading to rapid price swings of 20-30% within hours.

Stick to a strategy, avoid checking prices constantly, use alerts, and focus on long-term trends rather than short-term market noise.

Yes, emotional trading leads to panic selling and bad decisions. A solid trading plan and risk management help remove emotions from trades.