El Salvador is negotiating a $1.3 billion loan with the IMF that reportedly could bring significant changes to its Bitcoin legal tender law.

In the coming weeks, El Salvador could finalize a multi-billion dollar deal with the International Monetary Fund that might unlock more funding from global lenders. The only catch is that the country would need to reconsider its main bet, Bitcoin (BTC).

According to a Dec. 9 Financial Times report, which cites sources close to the matter, the talks also include commitments to tackle the country’s budget deficit as analysts forecast a fall in the general government fiscal deficit to 3.1% of GDP in 2025 from 3.9% in 2024.

Bold gamble

In 2021, El Salvador became the world’s first country to adopt Bitcoin as legal tender under the leadership of President Nayib Bukele. However, the move was immediately met with loud skepticism from global financial institutions, including the IMF, which flagged that such a bold move brings “large risks associated with the use of Bitcoin on financial stability, financial integrity, and consumer protection.”

El Salvador’s adoption of the cryptocurrency required local businesses to accept Bitcoin alongside the U.S. dollar, the country’s primary currency since 2001.

Relations between El Salvador and the IMF became strained, leaving the country isolated from international credit markets. However, Bukele doubled down on the Bitcoin experiment, branding the nation as a crypto-friendly haven and announcing plans for an ambitious “Bitcoin City” powered by geothermal energy from a volcano.

In August, Bukele revealed in an X post that Turkish company Yilport Holdings made the largest private investment in El Salvador’s history, around $1.6 billion, and will develop the port at the proposed Bitcoin City site in La Unión, a municipality in La Unión Department of El Salvador.

Mixed results

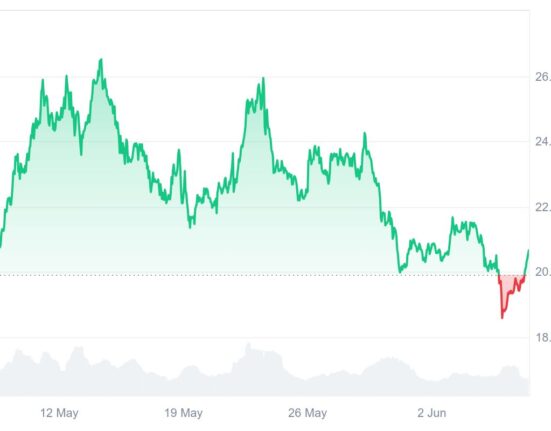

The adoption of Bitcoin has delivered somewhat mixed outcomes for El Salvador. On one hand, the move generated global headlines, attracted crypto enthusiasts, and bolstered Bukele’s image as a disruptor. Bitcoin’s price surge to over $100,000 this year has also boosted the value of the country’s cryptocurrency reserves.

According to Bukele’s recent post on X, El Salvador’s Bitcoin holdings are now worth over $550 million, reflecting a 127% gain. “You can call it our first #Bitcoin piggy bank. It’s not much, but it’s honest work,” he wrote.

For many Salvadorans, Bitcoin hasn’t quite lived up to its expectations. Even though it’s legally recognized, most people still prefer the U.S. dollar for their transactions. Many cite Bitcoin’s volatility and their lack of trust in it as reasons for sticking with the dollar. A survey from Francisco Gavidia University in San Salvador, conducted in 2024, found that only 7.5% of the 1,224 participants actually use Bitcoin for transactions.

Details on IMF deal

According to the Financial Times, the IMF loan deal would lead to changes in El Salvador’s Bitcoin policy, removing requirements for businesses that required them to accept BTC as a legal tender and making these payments optional. The government has also agreed to cut its budget deficit by 3.5% of GDP over the next three years, fight corruption, and increase foreign reserves from $11 billion to $15 billion.

The approval timeline is still uncertain, and it’s unclear if the changes mentioned above will be enough. However, the IMF loan could lead to another $1 billion from the World Bank and $1 billion from the Inter-American Development Bank, helping the country rejoin global financial markets.

Economic revival amid controversy

Bukele has maintained strong domestic support, buoyed by a sharp drop in crime rates following his crackdown on violent gangs. His re-election earlier this year with 85% of the vote might reflect his popularity, though his administration has faced criticism abroad for alleged human rights violations and corruption.

While the Biden administration initially criticized Bukele’s policies, recent months have seen a shift toward closer ties. El Salvador’s sovereign bonds rallied 22% earlier this year, closing the steep discount that previously alarmed investors. Bukele linked the bond rally to Bitcoin’s rise, calling it “the first time in history that Bitcoin has driven sovereign bonds up in traditional markets.”

Bitcoin’s surge to $100k

Bitcoin’s skyrocket price surge has definitely played its role in softening criticism of El Salvador’s crypto gamble. The crypto’s value boost provided a windfall for the government, helping to bolster reserves and partially vindicating Bukele’s strategy of buying Bitcoin during market dips.

Still, the country’s broader economy remains sort of fragile. With GDP growth slowing and public debt elevated, analysts caution that Bitcoin’s gains alone might not be enough to resolve structural economic challenges. The IMF loan agreement, if finalized, would certainly mark a big step in addressing these issues, albeit with conditions that require scaling back some of the crypto ambitions that first put El Salvador on the global stage.

The IMF has yet to publicly comment on the ongoing negotiations. For Bukele, the deal represents both a retreat from his Bitcoin bet and an opportunity to reset the country’s financial trajectory.