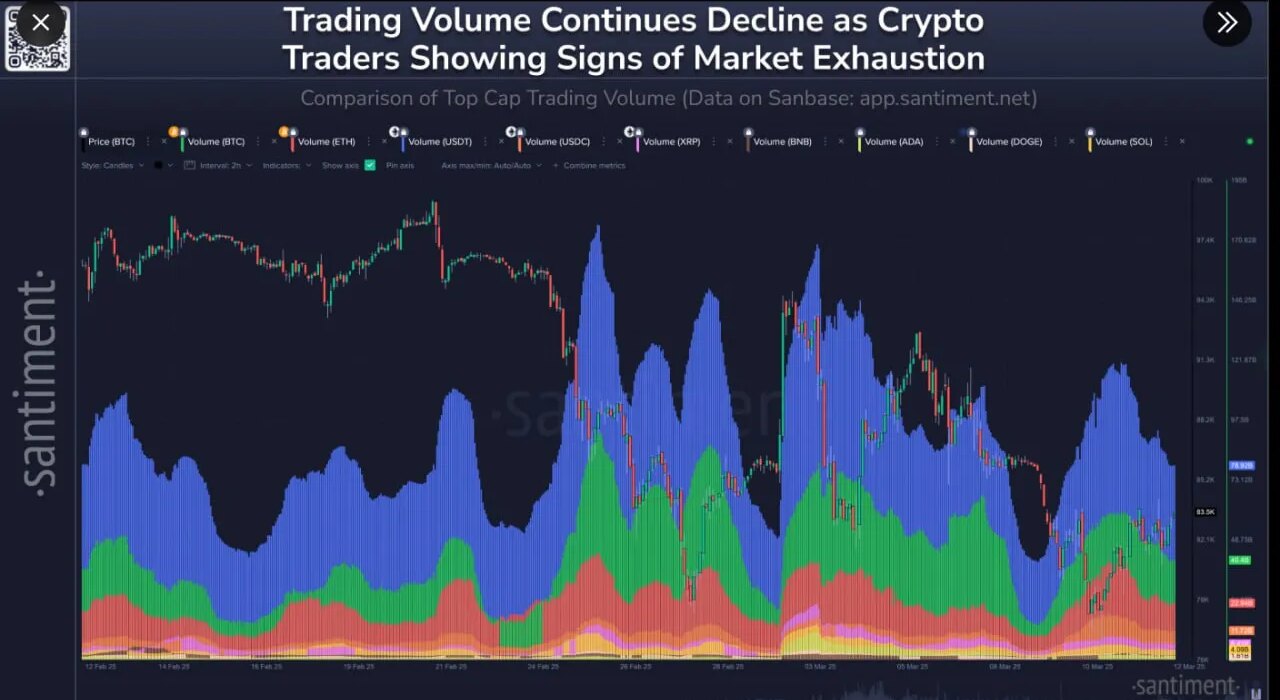

Santiment data revealed that crypto-wide trading volume has been on the decline since its peak in February. The analytics platform highlighted that the total crypto market lost $1.01 trillion since January.

Santiment data showed that the crypto-wide trading volume declined in the past few weeks. The analytics platform said the decline in market cap in the past two weeks indicates trader exhaustion and hopelessness.

Crypto trading volume has declined since its peak in February

Santiment data highlighted that the crypto market trading volume has declined by over 50% since February 27. According to Coigecko, the crypto trading volume hit its peak in early February hitting $440 billion. The data highlighted that it has since declined by 63% on March 12.

Santiment noted that in February, optimistic traders bought dipping prices that led to increased trading volumes across networks. It highlighted that the reduced trading volumes show that traders were exhausted from the persistent volatility.

The analytics platform explained that the trading volume for major cryptocurrencies consistently dropped even during the slight price recoveries. It added that this scenario indicated that traders became more cautious with their investments and did not believe that the price corrections would last. The platform added that investors also doubted they would yield profitable outcomes after buying the market dips.

Coinmarketcap data highlighted that the total market capitalization declined by over 25% since the beginning of February. The data indicated that the market cap decline accelerated since the beginning of March as traders responded to fears of recession in the United States.

Santiment reported that a weakening trading volume despite slight price bounces could serve as an early warning sign of weakening market momentum. The platform added that without buying participation, price gains could “lose steam”. It explained that this was a result of reduced underlying support to sustain an upward trend. Santiment added that the possibility of any rebound could be temporary, and the price could be vulnerable to another downturn.

📊 Crypto-wide trading volume has been dropping since its peak back on February 27th (when traders were optimistically buying dipping prices). After further market cap declines these past two weeks, trader behavior indicates a mix of exhaustion, hopelessness, and capitulation.… pic.twitter.com/0kqBVkKRpQ

— Santiment (@santimentfeed) March 12, 2025

The platform noted that shrinking volume during minor rebounds wasn’t necessarily bearish. It explained that trading volume was a metric that measured participation from both retail and institutional investors.

Santiment added that both groups waiting for the other to boost the market caps before their next moves could lead to price stagnancy. It warned that price stagnancies often lead to more declines in the long run. The platform reported that to signal a healthier and more sustainable recovery; bulls wanted to see simultaneous rises in price and volumes. It added that until trading activity meaningfully increased, cautious market sentiment was likely to continue.

Events in February derail market sentiment, leading to reduced volumes

The drop in market cap was triggered by multiple events that occurred in the past month. Defunct FTX announced it would start repaying its creditors through distribution providers Kraken and Bitgo.

According to Arkham data, the exchange began repaying users with FTX claims under $50,000. The data also indicated that the wave of creditors represented approximately $1.2 billion in value. Investors raised concern over the potential increase in supply that could cause further price plummets.

US President Donald Trump’s tariffs against Canada, China, and Mexico also increased market uncertainty. The uncertainty was reflected in the volume of crypto market trading and the overall stock market. Trump imposed a 25% tariff on all imports from the three countries. The countries responded by imposing reciprocal tariffs against the United States. Global stock markets, including cryptocurrencies, have since experienced significant declines.

Bybit, a crypto exchange, suffered a hack from the Lazarus group that saw it lose $1.5 billion. The hackers later cashed out at least $300 million from the proceeds of their hack. A QCP analyst noted that investors pre-empted the hacker’s willingness rather than risk further losses as an indication that the market was unlikely to recover further, derailing market sentiments.

Investors who expected more buying pressure after the establishment of the U.S. Bitcoin Reserve also expressed their disappointment after the executive order came into force. They said the order did not specify when the government would purchase additional BTC, further increasing market uncertainties.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot