Solana has rallied 70% against Ethereum in 2024. The native token of the smart contract blockchain has emerged as a strong contender against Ether, even as its market capitalization is nearly a third of Ethereum.

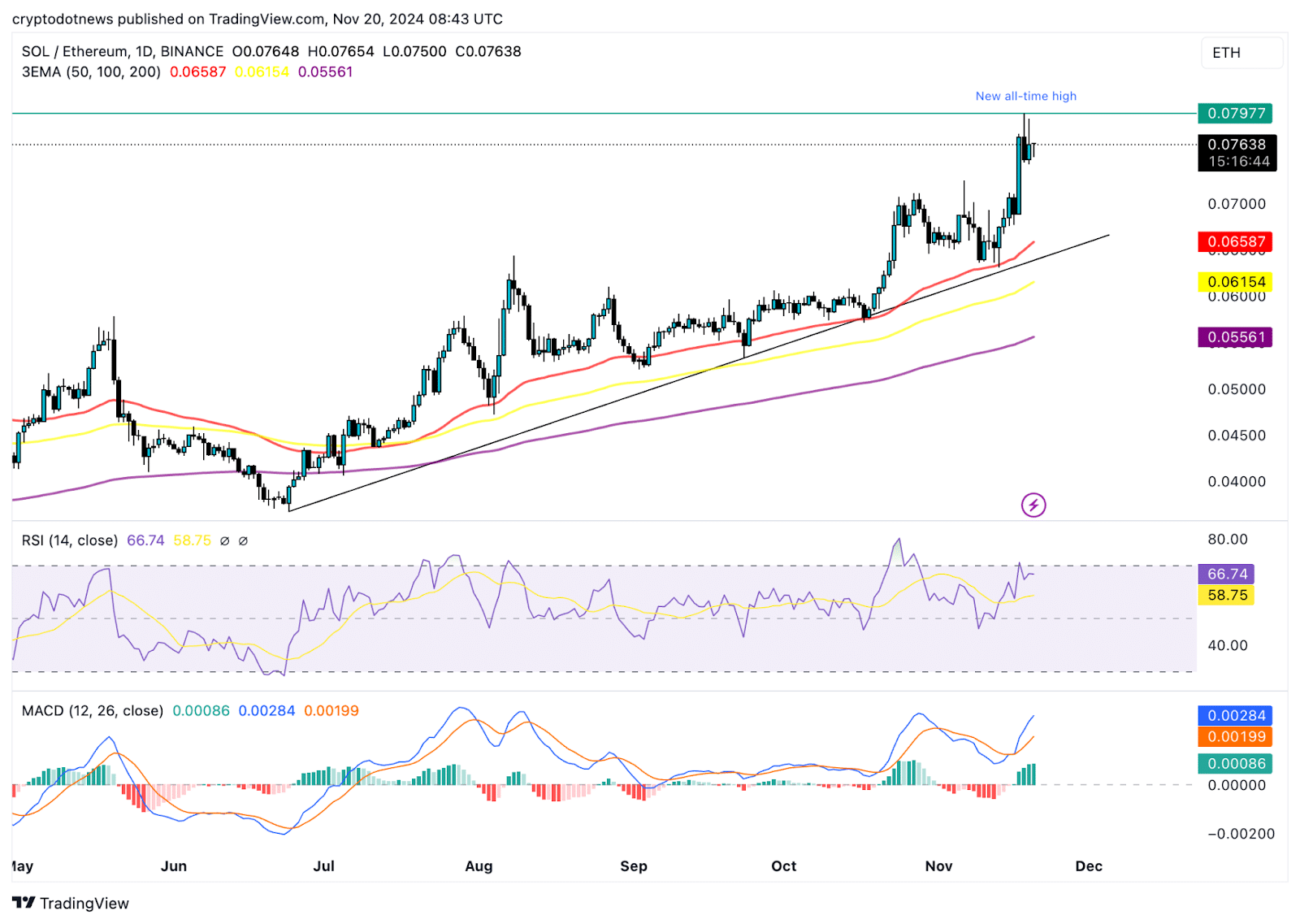

The ongoing debate in terms of Solana (SOL) overtaking Ethereum (ETH) is backed by bullish on-chain metrics, SOL’s dominance in DEX metrics, volume and protocol revenue. Solana hit an all-time high against Ethereum on Monday, November 18, when SOL/ETH climbed to 0.07977.

Solana could overtake Ethereum, on-chain metrics suggest

Solana’s protocol fees, a small percentage of the transaction value that is collected to maintain and facilitate trade on the blockchain, is nearly two times that of Ethereum in November 2024.

While the monthly date is incomplete, available data suggests Solana has collected $343.96 million in protocol fees against Ethereum’s $178.65 as of Tuesday, November 19. For a blockchain, once liquidity providers are paid, protocol fees add to the project’s revenue.

The metric, therefore, suggests higher revenue for Solana, compared to Ethereum, in October and November 2024.

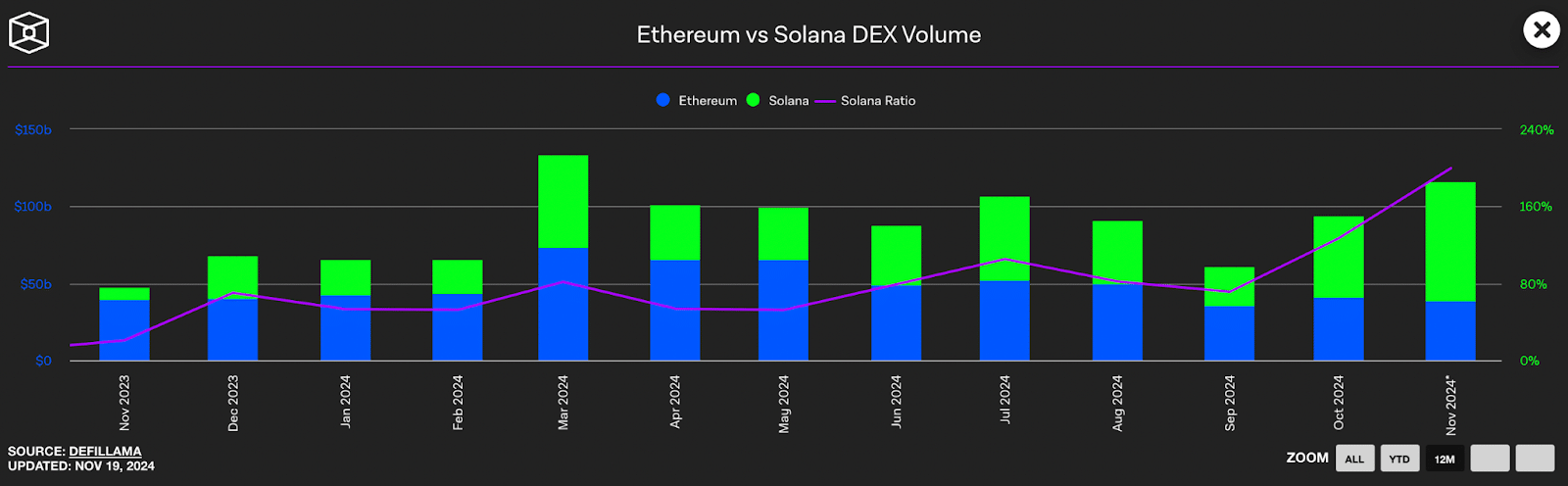

Another key metric is the transaction volume on decentralized exchange platforms or DEXes. In the case of Solana, DEX volume is nearly two times that of Ethereum in November. In October, SOL ranked higher in DEX volume, however by a relatively smaller margin.

Solana DEX volume is $77,51 billion against Ethereum’s $38,81 billion. For the month of October, Solana stood at $52.5 billion against Ethereum’s $41,4 billion.

Higher DEX volume translates to higher utility and adoption of one chain compared to the other. Solana has been preferred by traders on decentralized exchanges, likely due to the large volume of new projects on the launchpad Pump.fun, that are listed on DEXes like Raydium post hitting a key threshold.

Solana, therefore, emerges as a clear favorite among decentralized traders and platforms, per data from TheBlock.

Ethereum dominates in circulating stablecoin supply, and the total value of cryptocurrencies (TVL) is locked on the chain.

Solana struggles to compete with Ethereum in these metrics with a large difference, lagging behind as ETH benefits from its first-mover advantage. It is likely that with continued adoption and demand, Solana could overtake Ethereum in these metrics in the long-term.

How Solana could overcome challenges, and flip Ethereum

Solana’s ecosystem is observing the addition of new stablecoins, likely to push the circulating stablecoin supply and TVL metric higher. Sky, a decentralized finance lending and borrowing protocol formerly known as Maker, has deployed its USDS stablecoin on Solana.

This marks the first DeFi-native stablecoin launch on Solana, which could increase the Ethereum competitor’s DeFi liquidity.

Solayer launched sUSD, a real-world asset-backed stablecoin on the Solana blockchain last week. The token derives its value from a diversified basket of low-risk assets, starting with U.S. Treasury bills, making it different from all other stablecoins.

Similar developments in the Solana network could help SOL overcome the network effect and the first-mover advantage of Vitalik Buterin’s Ethereum blockchain, paving the way for a “flippening” in the future.

Why this matters, implications for your crypto portfolio

Solana-based meme coins crossed $22 billion in market capitalization, and 70% of the top 10 meme tokens have posted double-digit gains in the past seven days, CoinGecko data shows.

Solana’s rise against Ethereum has likely catalyzed gains in its ecosystem tokens, fueling meme coin rallies and pushing the overall market capitalization of the sector higher. This positively impacts crypto portfolios holding dog and cat-themed and politi-fi meme tokens alongside Solana.

Ethereum’s beta plays are the Layer 2 token ecosystem and Layer 3 projects, both the categories are struggling to gain traction in the ongoing cycle.

Crypto traders holding staking, re-staking, Layer 2 and 3 tokens are likely to observe unrealized losses on their portfolio as Ethereum struggles in the face of competition from alternatives like Solana.

Solana hits ATH against Ether, expect this from SOL price

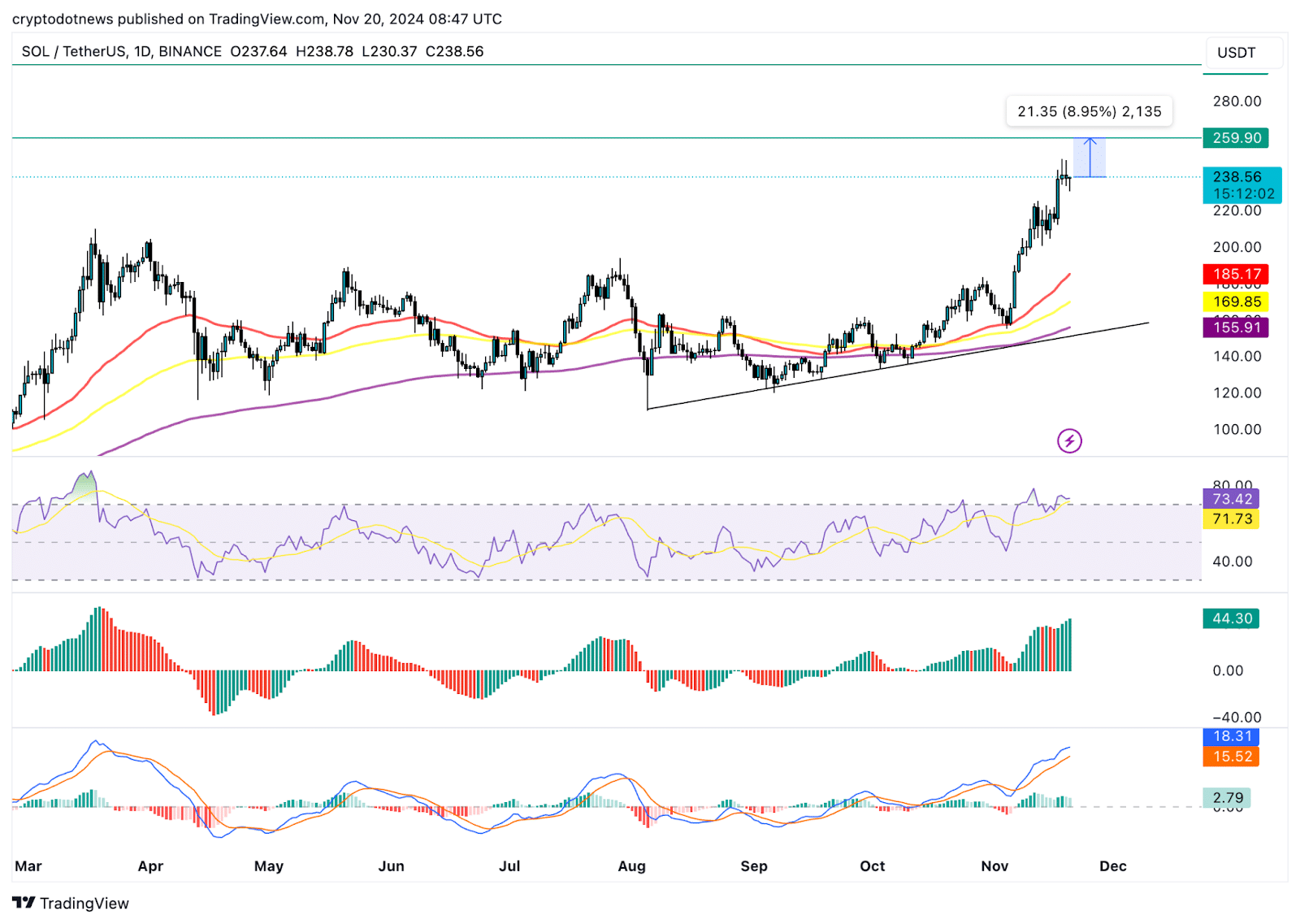

Solana hit a record-high when traded against Ethereum, at 0.079770 on Monday, November 18. The milestone is key for Solana, the SOL/USDT pair is less than 10% away from its previous all-time high at $259.90 from November 2021.

The SOL/ETH pair shows scope for further gains and a re-test of the all-time high at 0.079770, a 5% rally from the current level. SOL is currently trading above the three exponential moving averages at the 10, 50 and 200-day, and has been in an upward trend for nearly five months now.

Technical indicators, relative strength index at 66 and moving average convergence divergence indicator, with green histogram bars above the neutral line, support a bullish thesis for the SOL/ETH pair.

If Solana breaks past its all-time high and extends its gains, the SOL/ETH pair could target the 0.090000 level, 13% above its record high.

The SOL/USDT pair is trading at $238.56 on Wednesday, November 20, 8.95% below its all-time high. Technical indicators suggest further gains are likely in the pair and SOL could return to its record high.

A successful re-test of this level and a breakthrough could push Solana towards the psychologically important $300 mark, 15% above its all-time high at $259.90.

The RSI reads 73, while this may be considered a sell signal by traders, awesome oscillator flashes increasingly taller green histogram bars and MACD shows no signs of a trend reversal.

The momentum underlying SOL price trend is likely positive, supporting further gains in Solana.

The three EMAs could act as support in the event of a market correction.

Solana’s correlation co-efficient with Bitcoin is 0.98 per info from Macroaxis.com. Solana’s price trend is therefore expected to follow Bitcoin closely; a market correction in the latter could usher a decline in SOL, and traders need to consider this before adding to their positions in both assets.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.