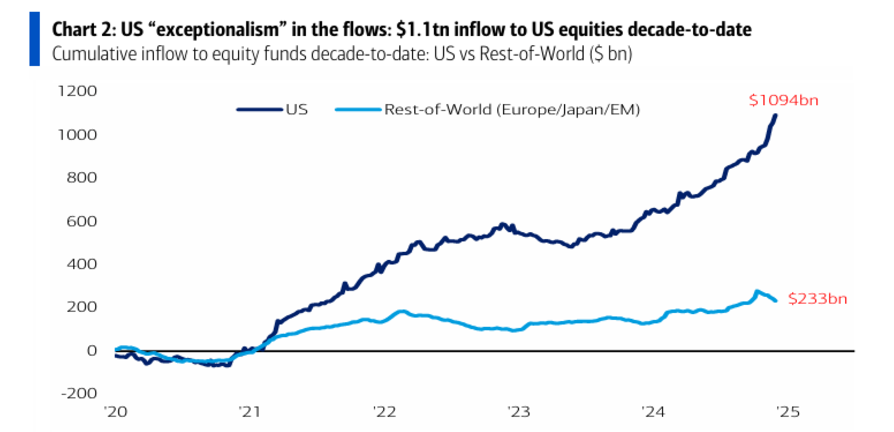

Bank of America Corp.’s Michael Hartnett has raised an alarm about the US financial market. He said that although US stocks and crypto have experienced robust rallies, the asset classes are appearing frothy.

After maintaining a pessimistic stance in 2023, the strategist chose a more neutral stance toward equities this year.

The S&P 500 experienced a 27% increase in 2024 and is currently on course to achieve its best year since 2019. This has been attributed to the optimism surrounding artificial intelligence and the belief that President-elect Donald Trump’s “America First” policies would stimulate domestic markets.

BofA’s Hartnett 2025 overshoot theory

Hartnett said that the S&P 500 is at a significant risk of “overshoot” in early 2025 if it reaches 6,666 points, which is approximately 10% above its current level. There is currently no indication of exuberance among global investors, as indicated by the bank’s bull-and-bear indicator.

According to reports, the S&P 500’s price-to-book ratio increased to 5.3 times in 2024, which is on the brink of the 5.5 times it reached at the height of the technology bubble in March 2000.

In a report published on November 28, Michael Hartnett said, “Invest in international stocks during the second quarter due to the aggressive easing of financial conditions overseas and the panic in Europe/Asia policy.”

In addition, according to BofA, investors should acquire 10-year US Treasuries when yields reach 5%, as this level would result in volatility and risk-asset losses, a peak “inflation boom,” and innovative solutions to reduce the US budget deficit.

Also, analysts at Bank of America suggest that investors seeking a contrarian investment in 2025 should invest in “BIG” – bonds, international equities, and gold. Hartnett agrees with this assertion.

The current situation in the crypto industry

Hartnett’s worries have substance, but they have not deterred progress in the crypto industry. Bitcoin’s recent surge beyond $100,000 has resulted in waves, with some tokens (especially memecoins) experiencing significant gains and others enduring precipitous declines.

Gigachad (GIGA) is one of the victors, as it experienced a 36% increase in value following its listing on Coinbase and Kucoin. GIGA’s price increased from $0.04146 to $0.06555; however, it has encountered resistance at approximately $0.050 since then.

Turbo (TURBO) has also experienced growth, as its listing on Coinbase has contributed to its price increase.

In the past 24 hours, Dogecoin (DOGE) and Shiba Inu (SHIB) have experienced increases of 6.6% and 4.2%, respectively. The value of the memecoin Keyboard Cat on Base (KEYCAT) increased by 21.8%, while the value of newer entries such as Ski Mask Dog (SKI) on the Base chain surged by 50.8%.

Fartcoin (FARTCOIN), however, experienced a 26.5% decline, while Moo Deng (MOODENG) experienced a substantial 19.5% decline.

Other tokens, such as Fwog (FWOG) and Non-Playable Coin (NPC), also experienced losses, with a 9.4% and 13% decline, respectively.

In addition, problems have arisen for specific tokens due to developer manipulation. The value of Flog the Frog (FLOG), a once-promising memecoin, experienced a significant decline after its developers sold their holdings, resulting in a collapse.

Hawk Tuah (HAWK) has encountered comparable challenges, as evidenced by its 92% decline in value subsequent to fraud claims surrounding its introduction.

On the other hand, the US dollar weakened as mixed economic data shaped market sentiment, which may affect the stablecoins attached to it. This occurs in the context of a broader market shakeup, which has resulted in $570 million in liquidations since Bitcoin’s fleeting decline from $100,000 to $93.7K on December 5.

Crypto optimists say otherwise

ARK Invest, a firm known for its positive views on Bitcoin, predicts a minimum year-end price of $124,000, based on a performance multiple of 2.48x to 2.94x. Their analysis identifies increased institutional interest and proposes that Bitcoin might be considered for US strategic reserves, which they believe would dramatically increase its market value.

Jelle, a well-known analyst, indicated a bullish pennant breakthrough and set a goal of $130,000. Another trader, Aksel Kibar, cited $137,000 as Bitcoin’s next key resistance level, claiming that $100,000 is not a psychologically or technically significant price point.

Kalshi’s analysis also shows a 10% chance of Bitcoin reaching $150,000. However, more ambitious predictions, such as Bitcoin reaching $250,000, are viewed skeptically, with Polymarket assigning only a 2% probability to this scenario.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan