Bitcoin-based DeFi protocol Avalon Labs has announced its plan to launch a Bitcoin-backed debt-focused public fund compliant with the US Securities and Exchange Commission (SEC) regulations. In an announcement on X, the firm said this is part of its plan to expand its products in the US.

According to the company, it is currently researching the possibility of creating Bitcoin-backed financial products. While still in the exploratory phase, Avalon is assessing whether it can use the SEC Regulation A Exemption to launch the debt-focused public fund backed by Bitcoin.

The Regulation A Exemption under the Securities Act of 1933 enables private companies, trusts, and fund managers to access public markets and issue securities to retail investors without becoming a public company. Commonly called the mini-IPO, this exemption allows companies can raise capital through a public offering of their securities without going through the full SEC registration process.

Avalon Labs is evaluating whether it can apply this exemption to issue Bitcoin-backed lending products. The company claims that achieving this could be a major milestone in its efforts to build a Bitcoin-based capital market.

It said:

“By exploring regulated investment structures, we aim to bridge the gap between traditional finance and crypto, opening new opportunities for Bitcoin-backed financial products.”

Meanwhile, Avalon did not provide full details on the public fund but noted that there is no precedence of the SEC applying this exemption for firms in the crypto industry. Still, the company is bullish on its chance. Avalon Labs co-founder Venus Li noted that its analysis of previous SEC approvals shows a viable path ahead.

Li said:

“The SEC’s role is to protect retail investors and ensure fairness, not to hinder technological progress. We are confident they will assess any future applications objectively.”

This view is evidence of the change in the crypto industry sentiments towards the SEC since the exit of Gary Gensler. With the new administration expected to be more permissive, many expect that the industry will see more developments in the next few years.

ByBit list Avalon token

Meanwhile, Avalon’s plan to launch a compliant Bitcoin-backed debt aligns with the company’s broader goal of increasing the adoption of Bitcoin-backed products. The platform, which describes Bitcoin as the only true digital gold, aims to create products that unlock Bitcoin DeFi yield and make it accessible to everyone.

As part of that goal, Avalon already has the USDa stablecoin which is fully collateralized with BTC. The stablecoin which is based on Ethereum has a supply of around $30 million according to data from Defillama.

It remains strongly focused on making Bitcoin become more than a store of value and turning it into a financial instrument capable of serving multiple purposes and generating yield. Late last year, the company completed raising $10 million in Series A funding to grow its Bitcoin DeFi ecosystem.

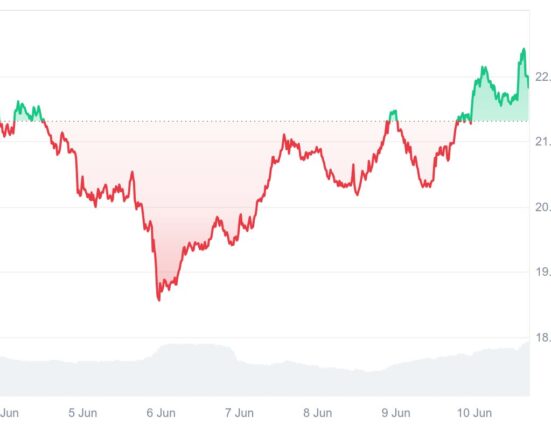

Beyond its stablecoin, Avalon recently announced that its native token AVL has been listed on the ByBit exchange. With a supply of one billion tokens, the ByBit listing which happened on February 12, has led to other centralized exchanges such as Gate.io and HTX to also list the token.

However, major exchanges such as Binance and Coinbase are yet to list the token. Following its initial listing today, AVL reached as high as $0.598 on CoinGecko, but it is now down more than 30% to $0.4066.

Cryptopolitan Academy: FREE Web3 Resume Cheat Sheet – Download Now