- Bitcoin’s price rebounds above $97,000, rising 2.3% after dropping to $94,000.

- A shift in the MVRV ratio and dormant coin movement may indicate long-term holders are influencing market trends.

Bitcoin [BTC] has experienced a noteworthy shift in momentum after a steady decline last week brought its price as low as $94,000.

In the early hours of the 10th of February, BTC began to recover, with its price climbing above $97,000—a 2.3% increase over the previous day.

While this upward movement is a positive development, a deeper analysis of the network’s underlying metrics sheds light on the potential future direction for the leading cryptocurrency.

A recent analysis from CryptoQuant highlighted a significant movement on the Bitcoin network. On the 10th of February, approximately 14,000 Bitcoins, dormant for seven to ten years, were suddenly moved.

Importantly, these coins were not sent to exchanges, suggesting they were not intended for immediate liquidation.

The CryptoQuant analyst reporting this particularly wrote:

“It’s important to note that the average acquisition price of these coins is quite low, which could influence the holders’ future decisions regarding potential sales.”

Bitcoin current MVRV ratio and its implications

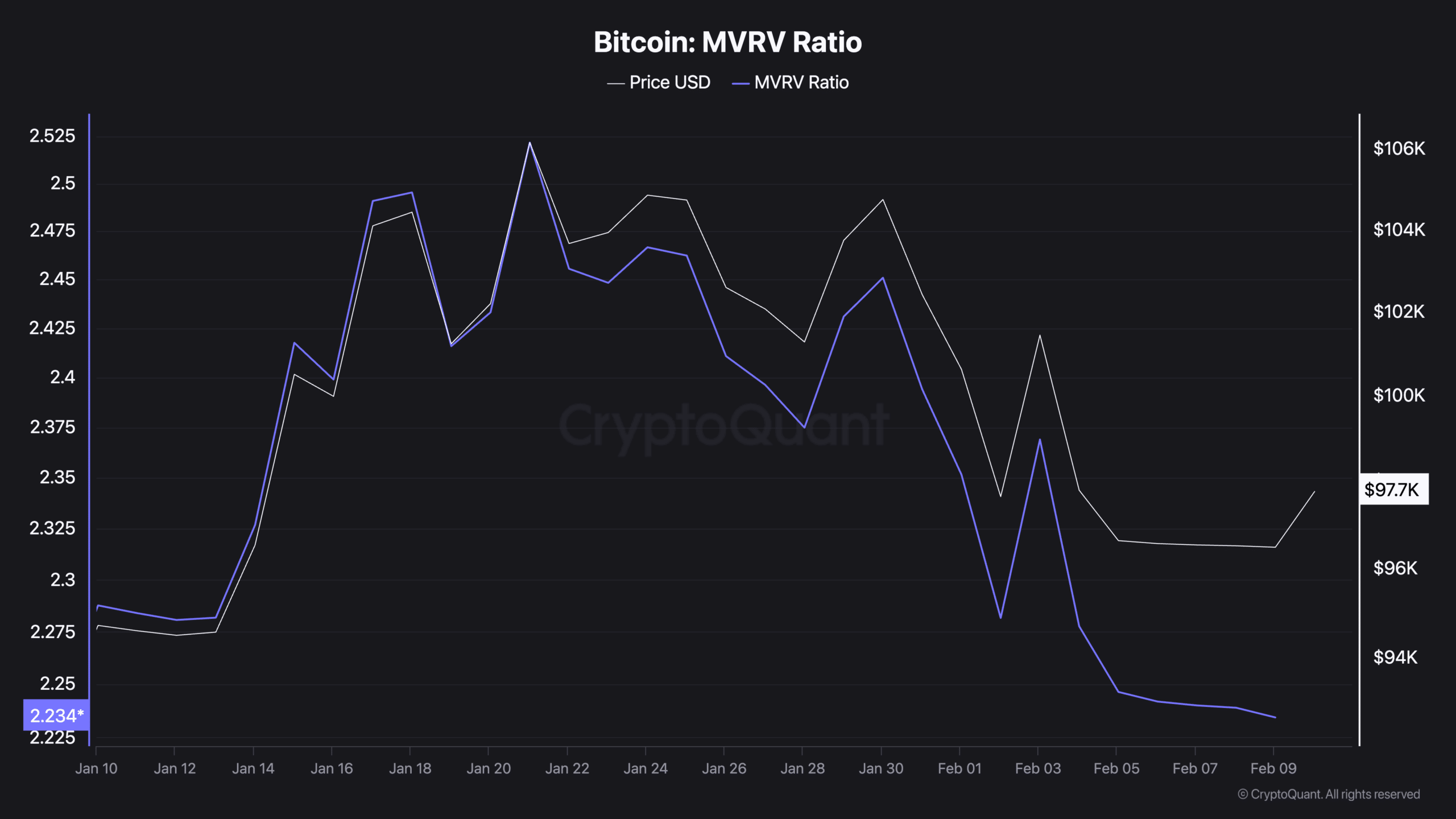

More importantly, the MVRV ratio also provided valuable insights into Bitcoin’s market health.

The MVRV (Market Value to Realized Value) ratio measures the market capitalization of Bitcoin against its realized value—the total value of all coins at the price they last moved on the blockchain.

This ratio can serve as an indicator of whether the asset is overvalued or undervalued at current price levels.

Recent data from CryptoQuant also revealed a downward trend in Bitcoin’s MVRV ratio, aligning with its recent price declines.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

On the 21st of January, the MVRV ratio stood at 2.52. However, following the drop in BTC’s market price, it had fallen to 2.23 as of the 9th of February.

Historically, when the MVRV ratio dips, it has signaled potential entry points for long-term investors. However, if the ratio continues to decline, it may indicate lingering market weakness or caution among investors.