Genius Group, an AI-powered education organization, has announced that it plans to adopt a “Bitcoin-first” investment approach. In a press release, the company shared that it plans to use Bitcoin as its primary treasury reserve asset. This move aligns perfectly with the current trend of public firms integrating cryptocurrencies, especially Bitcoin, into their reserve assets.

According to the announcement, the firm plans to hold 90% or more of its current and future reserves in $BTC. This underscores the company’s strong belief in Bitcoin’s long-term value.

Genius Group’s move came after the recent reorganization of its board, which now includes Web3 and blockchain experts. In line with the “Bitcoin-first strategy,” the firm aims to sell $120 million shares and use the funds to purchase Bitcoin. This will strengthen the company’s financial position and allow it to utilize $BTC as a digital store of value.

Educational Expansion And Adoption of Bitcoin

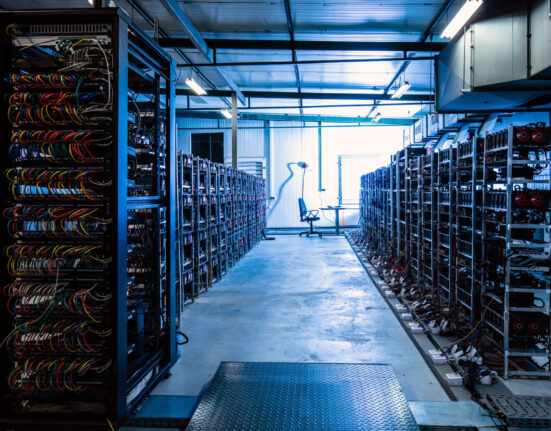

Genius Group’s new strategy is not constrained to treasury management. The company plans to integrate Bitcoin into its educational offerings and technological infrastructure. It will do so by launching a Web3-based education series named “Web3 Wealth Renaissance.” The series will equip students with the skills and know-how needed to navigate decentralized technologies.

By promoting web3-based education, Genius Group will position itself as a leader in the EdTech sector. Furthermore, the company is taking the initiative to allow Bitcoin payments in its EdTech platform. This feature will provide platform users, including students and shareholders, access to broader payment options, thus benefiting from decentralized finance.

According to Thomas Powers, the Director at Genius Group, “the company is focused on educating students for the exponential technologies of the future. We see Bitcoin as the primary value store that will power these exponential technologies. The compelling case that we believe Michael Saylor and Microstrategy have made for public companies to invest in Bitcoin as their primary treasury reserve asset is one that we fully endorse.”

Based on his comments, Thomas strongly believes that Bitcoin and cryptocurrencies generally have ushered in a new financial era. Through their Bitcoin-first strategy, Genius Group aims to join in on the transition.

Genius Group to Hold A Podcast To Discuss Their New Strategy

Genius Group plans to hold a GeniusLIVE podcast on Tuesday, November 19, 2024, from 9 a.m. ET to gain further insight into its Bitcoin-first strategy. The podcast will feature Thomas Power (Director at Genius Group), Roger Hamilton (CEO at Genius Group ), and Ian Putter (Director at Genius Group).