JPMorgan analysts have identified several critical factors that could influence the cryptocurrency market in the coming months, citing technical, geopolitical and structural events that may drive price movements. In a research report released Monday, the analysts discussed the impact of the seasonal “Uptober” trend, the U.S. Federal Reserve’s interest rate cuts, the approval of bitcoin exchange-traded fund (ETF) options, and Ethereum ETH

+1.68%

’s upcoming Pectra upgrade.

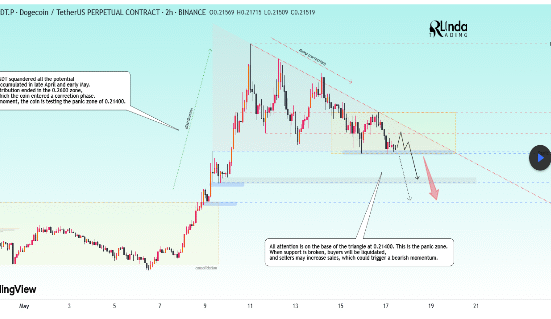

October tends to be a bullish month for crypto

One of the report’s key takeaways is the historical trend of strong October performance, popularly referred to as “Uptober.” The analysts highlighted that more than 70% of all Octobers have yielded positive returns for bitcoin.

“While previous performance is not a predictor of future performance, we think this popularization of ‘Uptober’ may influence behavior and result in a positive month for bitcoin this October,” the analysts wrote.

Bitcoin  BTC

BTC

+1.94%

price trends during the month of October over the past decade. Image: Bloomberg Finance.

The Fed’s rate-cutting cycle is yet to influence crypto market cap

Despite recent interest rate cuts by the Federal Reserve, JPMorgan analysts noted that the broader cryptocurrency market has yet to see the anticipated positive effect. While a declining interest rate environment typically supports risk assets, the correlation between the total crypto market capitalization and the Federal Funds rate remains weak at 0.46, they said.

“We have yet to see the ‘pop’ in cryptocurrency prices expected from lower rates since the Fed’s September 18 cut,” they wrote, adding that the market may be waiting for more sustained stability before shifting decisively.

Furthermore, the analysts acknowledged that the lack of historical data complicates making firm predictions about how cryptocurrencies respond to rate cycles. “Crypto assets really only emerged in the early-to-mid 2010s, and rates were near zero for most of their existence. It’s possible that stable rates, rather than just low ones, will benefit these markets the most,” they said.

Bitcoin ETF options could deepen market liquidity

Another potential catalyst is the recent approval of options trading on spot bitcoin ETFs. The analysts expect this could deepen liquidity and attract new participants to the market. “With options, investors now have a more dynamic way to engage with the ETF and drive liquidity in the underlying asset,” they noted. They added that this development could initiate a positive feedback loop, enhancing the market structure and making digital assets more accessible to institutional investors.

In mid-September, the U.S. Securities and Exchange Commission (SEC) approved the listing and trading of options for BlackRock’s iShares Bitcoin Trust spot ETF on the Nasdaq. However, final approval still depends on the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC).

Pectra upgrade could have long-term impact on Ethereum

The upcoming Ethereum upgrade, known as “Pectra,” was also highlighted as a major development. A combination of the Prague and Electra updates, Pectra will implement over 30 Ethereum Improvement Proposals (EIPs) to improve network efficiency, validator operations and expanding account abstraction.

“While Pectra is expected to be transformational for Ethereum’s functionality, we view this upgrade as more structural than an immediate price catalyst,” the analysts said. They see the long-term impact of Pectra as boosting Ethereum’s operational efficiency and adoption but unlikely to trigger a short-term surge in ether’s price.

Overall, JPMorgan analysts concluded that the cryptocurrency market is in a holding pattern, awaiting a clearer macroeconomic or structural catalyst to drive sustained growth. We continue to see the crypto ecosytem being incrementally more sensitive to macro factors, so we await the next major catalyst for development and enhanced retail engagement to provide secular growth for the ecosystem,” they said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.